The Signal: A Counter-Intuitive Drop

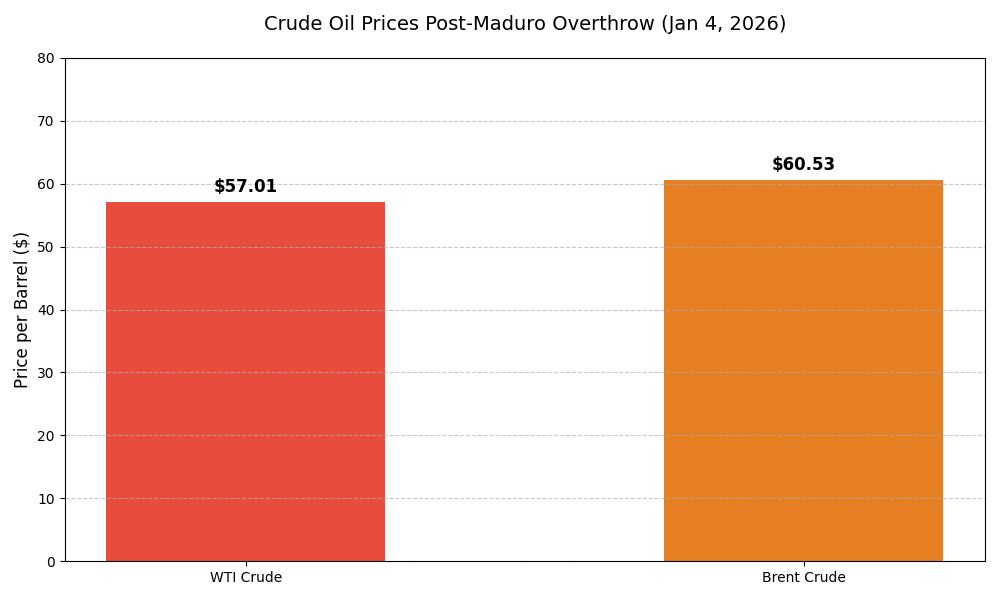

Despite the overthrow of Venezuelan President Nicolas Maduro—a major geopolitical shock—global crude prices have edged lower. WTI Crude fell 0.54% to $57.01, and Brent dropped 0.36% to $60.53.

This market reaction defies the traditional logic that “instability equals price spikes.” The key driver appears to be President Trump’s explicit declaration: “We’re going to have our very large United States oil companies go in and help them out.”

The Analysis: Supply Efficiency vs. Chaos Premium

- Market Pricing Efficiency: The market is effectively pricing in a “US Efficiency Premium.” Traders are betting that US oil majors (Exxon, Chevron) will rehabilitate Venezuela’s crumbling infrastructure faster than the previous regime could mismanagement it.

- The Risk Factor (RBC View): Helima Croft of RBC Capital Markets rightly points out the risk of a “Libya/Iraq style” chaotic transition. If the power vacuum prolongs, the current price drop could be a bear trap.

- Goldman Sachs View: Short-term ambiguity remains. The immediate supply disruption is minimal because Venezuela’s output was already at historic lows.

The Verdict: Bearish Short-Term, Volatility Expected

I am positioning for volatility but leaning bearish on oil in the short term.

The entry of US efficiency into Venezuela’s reserves (the largest in the world) is a long-term deflationary pressure on oil prices. However, I advised caution on shorting aggressively here. The “Chaos Premium” could return instantly if the transition turns violent.

Action Plan:

- Watch: US Oil Majors (XOM, CVX) for entry signals as beneficiaries of the new policy.

- Avoid: Long positions in Oil Futures until the transition roadmap is clear.

⚠️ Disclaimer

This is not financial advice. Do your own research.