☕ TL;DR

- Record Breaker: Samsung Electronics posted an all-time high quarterly operating profit of 20.1 trillion won ($14.1B).

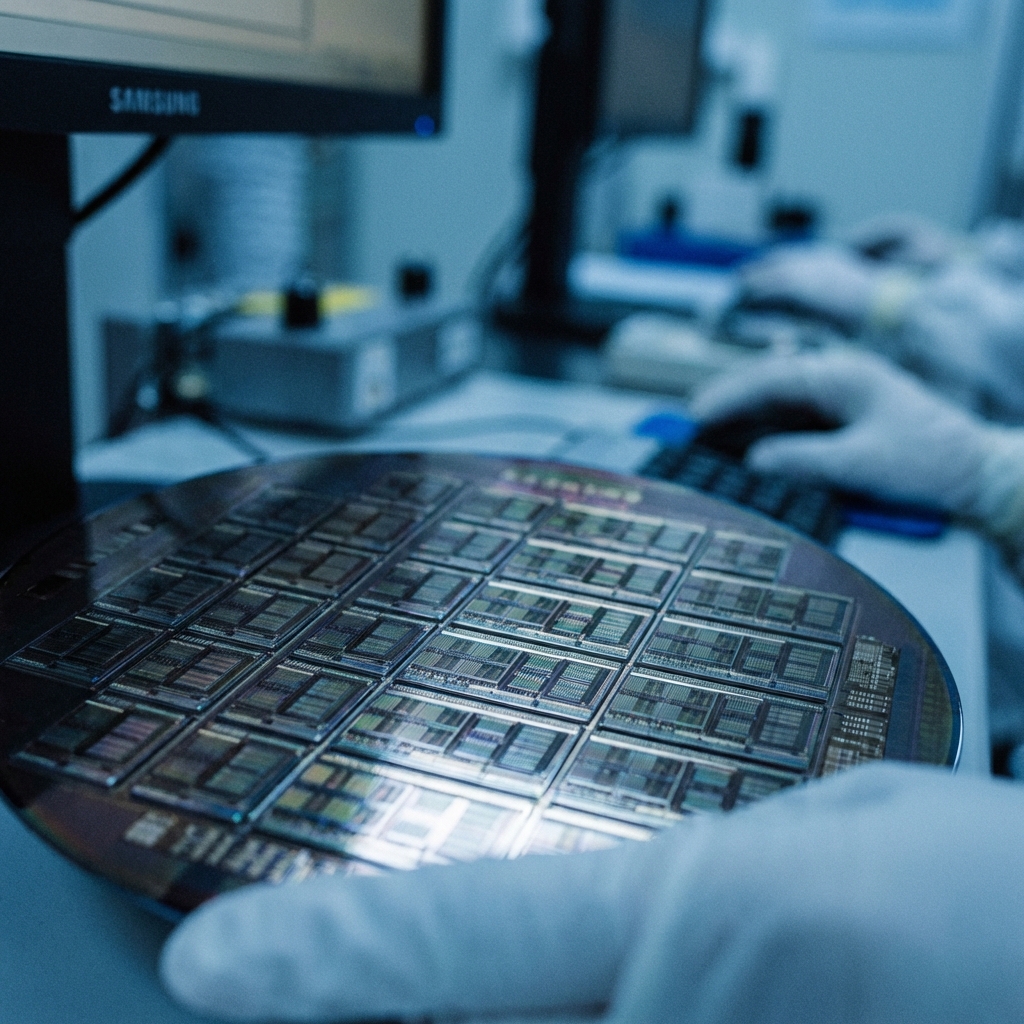

- AI Engine: The surge was driven by insatiable demand for High-Bandwidth Memory (HBM) and AI server infrastructure.

- Next Act: The upcoming Galaxy S26 series will pivot toward “Agentic AI” to reclaim dominance in the premium smartphone segment.

The Signal: A New Era of Profitability 📈

Samsung Electronics has smashed through its previous records, reporting 20.1 trillion KRW in operating profit for Q4 2025. Revenue also hit a historic 93.8 trillion KRW. This isn’t just a recovery; it’s a structural shift fueled by the AI infrastructure build-out.

The data suggests that the semiconductor division (DS) is now operating at peak efficiency, offsetting sluggishness in other units. Samsung has effectively transitioned from a general memory provider to a critical AI hardware bottleneck.

Why It Matters: The HBM Shortage & Pricing Power 💎

The primary driver behind this performance is High-Bandwidth Memory (HBM). As AI chipsets (like Nvidia’s) face unprecedented demand, storage solutions have become the limiting factor.

- Supply Constraint: Global HBM capacity is effectively sold out for the foreseeable future.

- Pricing Leverage: This scarcity has given Samsung immense pricing power, leading to record-breaking margins in its flagship memory business.

| Metric | Q4 2025 Result | Significance |

|---|---|---|

| Revenue | 93.8T KRW | All-time High |

| Op. Profit | 20.1T KRW | All-time High |

| DS Division | (Est) >15T KRW | The primary growth engine |

The Divergence: Mobile Faces Competition 📱

While the semiconductor unit flies, the Mobile Experience (MX) division recorded a 9.5% YoY dip in operating profit (1.9T KRW). The “launch effect” of previous models has tapered off, and competition in the high-end market remains fierce.

However, the strategy is shifting from volume to value. Samsung is not doubling down on specs; it is doubling down on smarter software.

The Strategy: Betting on Agentic AI 🔮

Samsung is betting its mobile future on “Agentic AI.” Unlike the current generative AI features that assist with tasks, Agentic AI in the upcoming Galaxy S26 series aims to act as a proactive digital assistant, capable of cross-app execution and intentional task completion without granular user input.

This pivot is designed to spark a replacement cycle among premium users and restore margins in the MX division to semiconductor-like levels.

Verdict: Bullish on the Supercycle 🚦

My verdict is clear: The AI supercycle in memory is far from over. As structural demand for AI servers continues to rise in 2026, Samsung’s bottleneck position in HBM provides a strong floor for earnings.

Action Plan: Monitor HBM4 development timelines and the market reception of the “Agentic AI” features in the S26. If Samsung can mirror its hardware dominance with a software-led mobile moat, the growth story remains robust.

Hedge Fund Analyst Memo “Samsung is no longer just a hardware vendor; it is an infrastructure play. The divergence between memory and mobile is a feature, not a bug, allowing the group to fund next-gen AI R&D through peak-cycle profits.”

[!IMPORTANT] Disclaimer: This content is for informational purposes only and does not constitute financial advice. All investment decisions should be made based on your own judgment and responsibility.